Jan 2023

Jan 2023

StoneX Bullion round-up Monday 9th January 2023

By StoneX Bullion

Wishing all our readers a very Happy, safe, and prosperous New Year

Happy New Year! Since our most recent note, before Christmas, gold has moved up a gear and silver appear to be consolidating in its new higher range, which it established in the first half of December. As we write gold is assaulting $1,875, a seven-month high, while silver is trying to consolidate around $24.0, a level that it has been testing since mid-December.

Gold, Silver and the Ratio

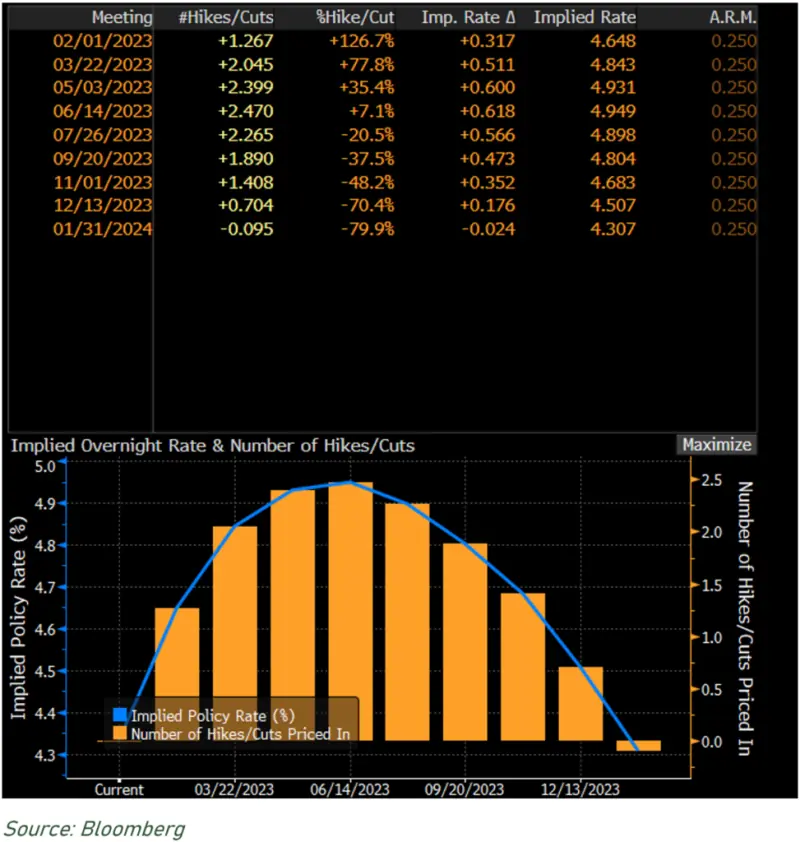

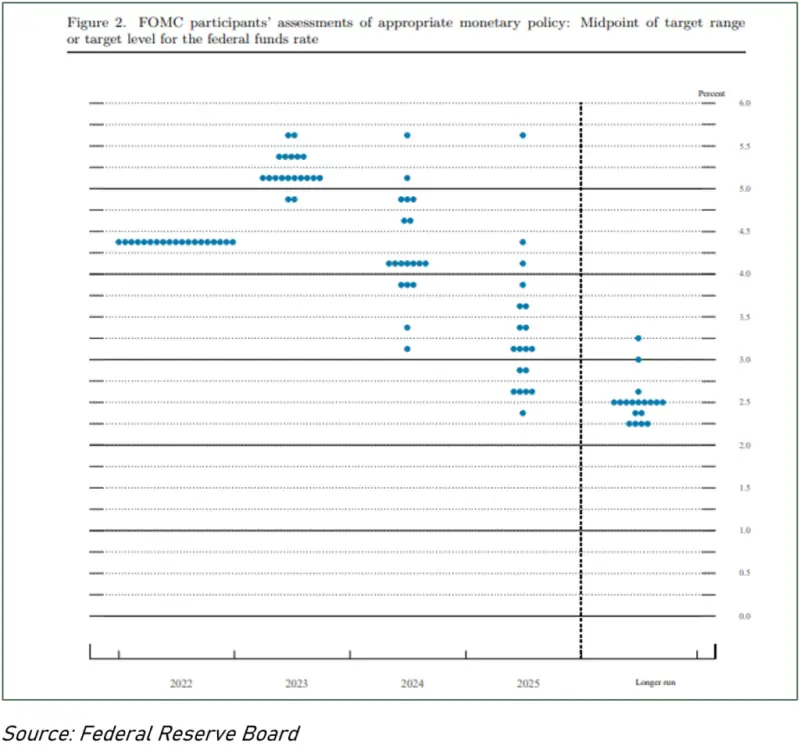

It feels to us as if there has been some substantial pre-positioning by professional investors, possibly with a view to the U.S. rate cycle peaking this year (which may or may not happen – the bond market si still more benign than the Fed’s rhetoric, which is still “higher for longer”). In addition, the European Central Bank remains hawkish and is talking of a sustained period of aggressive moves in order to bring inflation (Harmonised CPI currently 11.1%, core at 7.8%) back towards 2%.

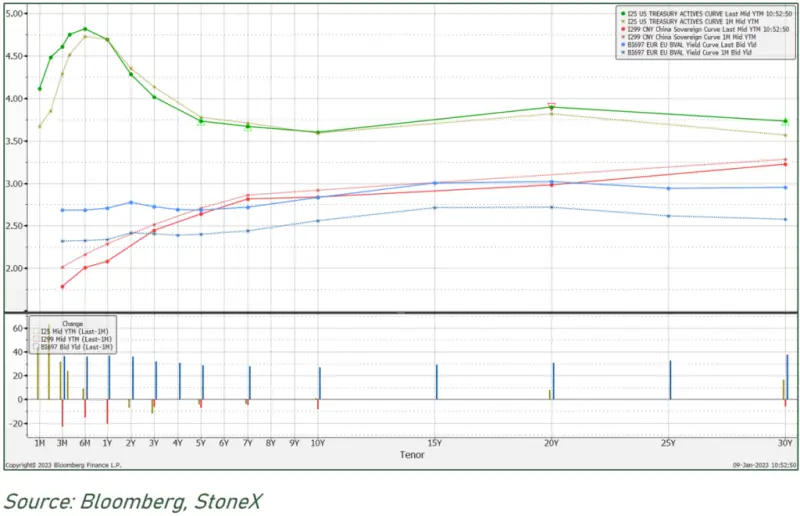

This underpins our belief that the long dollar:long yield trade is nearing the end of its validity – not just on an interest rate -differential basis (EU rates are not, at least in the bond markets’ view, likely to catch up with those in the States), but because the EU (geopolitical considerations permitting) should soon start to catch up with the U.S.-led recovery. It will take time and the ECB has a fine line to tread. The latest European countries’ PMI (Purchasing Managers’ Index) numbers are improving, especially in Germany, but they are all still below 50, which is the neutral level.

The U.S., E.U. and China yield curves

The sense of shift in sentiment, in gold at least, is backed up by the available market numbers.

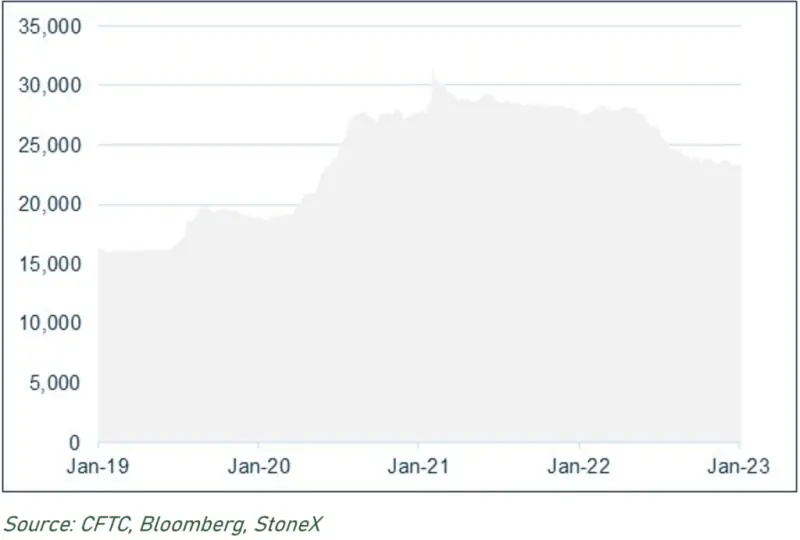

In the gold Exchange Trade Products sector, for example, outflows have dropped substantially. Holdings peaked during April after substantial post-Ukraine invasion purchases, especially in Europe. Since the end of April through to end-November (the World Gold Council, which tracks by far the greatest number of funds, has yet to publish year-end figures) holdings dropped from 3,888t to 3,477t, a fall of 411t for a monthly average of 59tr. The holdings tracked by Bloomberg only fell by six tonnes in December. The first (very few) days of January are showing a small net increase of two tonnes.

Similarly, the outright long-side COMEX positions among the Money Managers have been rising gradually since late-November, from 274t at end-month to 339t on Tuesday 3rd January, the latest date for which figures are available. Similarly, the outright shorts have been contracting, from 228t at end-November to 170t on 3rd January; this takes the net position from a long of 46t to a long of 170t.

This is the largest net long since mid-June 2022 and does obviously open up the possibility of profit taking, although it compares favourably with the 12-month average, which is a net long of 138t.

Silver has been similar, if marginally less convincing, with ETP positions posting a net fall of 393t in December for an overall drop for 2022 of 4,332t or 16% of the end-2021 level. That said, the rate of attrition had slowed noticeably towards year end: -

The Managed Money numbers are very slightly different from gold. While the outright longs increased over December (5,941t to 7,544t, a gain of 1,603 or 27%), for most of the month the shorts contracted, before adding to their positions in the week to 3rd January. It looks as if this was fresh short positioning die to the apparent stiff resistance at $24. Overall, the net long rose from 2,185t to 4,465t, this too may pose the risk of profit taking since the outright long was at the highest since mid-April, while the net long is substantially higher than the twelve-month average of 1,682t.

Retail demand for silver remains strong although it seems to have slipped in India following the recent rise in local prices (a 16% gain over December), while coin demand is still strong around the world in both metals and looks set to remain that way. Full-year figures from the U.S. Mint are showing zero against silver Eagle sales for September-December, which reflects a shortage of supply, not a lack of demand. Gold Eagle sales over the year were 23% down in 2021, with contained gold value down 21% but here, too, this represents difficulty in sourcing supply rather than dwindling demand.

Key charts

FOMC December dot plot

Gold (inverted) and the two and ten-year yields; correlation with the 10Y

Gold and the S&P; ratio