Nov 2025

Nov 2025

Silver May Drop $5 Amid Market Uncertainty

Gold and silver marking time but silver’s chart could be heralding another $5 fall

- Given the volatility in a number of areas that influence sentiment in gold and silver, it's hardly surprising, especially after their strong runs over the course of this year, that they are standing back and watching warily as world issues develop.

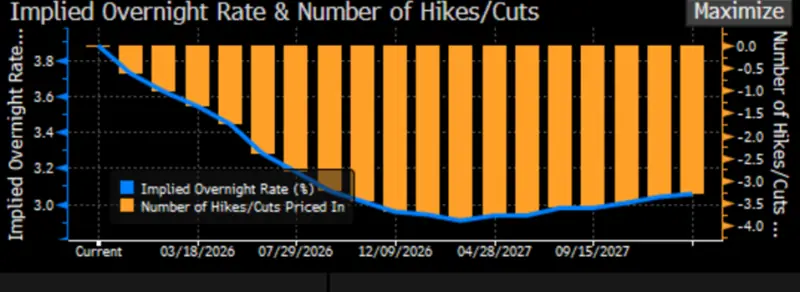

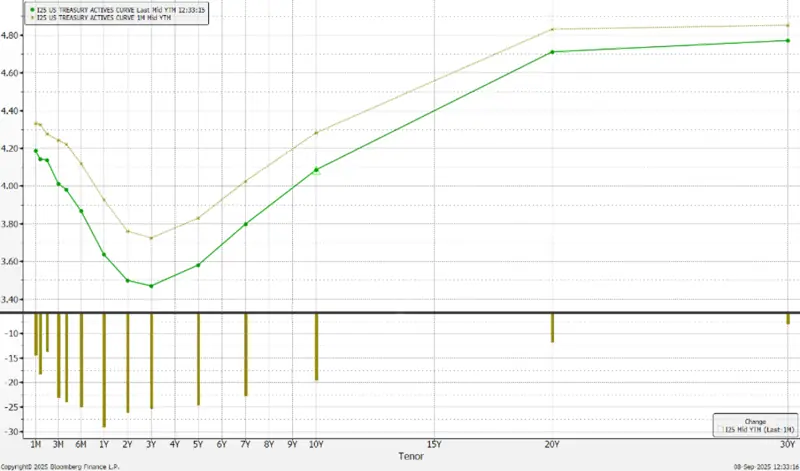

- While we have been arguing recently that Fed policy with respect to interest rates is perhaps less important in the long-term than the potential risk to Fed independence, which remains a very important feature for 2026, the rate argument is still capturing attention, especially ahead of this next meeting.

- The short term has seen wildly varying views in the bonds and swap markets as to what the Fed will do at the end of its meeting on the 9th/10th December. Jay Powell has kept his counsel and an independent observer has suggested that it's probably a very wise course because it has left the stage open for an increasing variety of views to be voiced by other members of the FOMC, fostering healthy debate.

- Three weeks ago the swaps markets were discounting a 66% probability of a 25-basis point cut from the Fed. In the middle of this past week that dropped to 24% after the Minutes were released of a hawkish Fed meeting in October.

- Then, after a strong headline nonfarm payroll figures, the employment numbers were subsequently seen as being slightly weaker than the headlines would have suggested, with unemployment rising to 4.4% and the chances of a rate cut have been boosted again, at least as far as the bond markets are concerned, with a current 63% expectation of a fall.

- Elsewhere of course, the eyes of the world are focused on the latest developments with Russia and Ukraine and the 28-point US proposal to be put to Ukraine with a deadline for acceptance of this coming Thursday. This has met with adverse reaction across Europe in the Ukraine itself of course, but more significantly there are waves of Congress that disapprove and indeed one Senator has said that it looks like a US pass-through of a Russia proposal -something that has being countered by the White House. The president has subsequently said that it is not his last offer.

- So these are the two key geopolitical influences that are surrounding the gold and silver markets at present. Within the markets themselves, silver continues to come out of COMEX and make its way towards London (and elsewhere).

- From early September to the end of last week COMEX inventories have fallen from 16,491t to 14m329t. However, even though conditions are easier, the lack of clarity persisting over the implications of silver being placed on the critical minerals list, which gives the option of imposing quotas and or tariffs, we do not believe that the market has come back to full stability as yet.

- World Gold Council numbers show that gold ETFs have added 693t so far this year with some profit taking being met by fresh buying interest.Net increases of 55t in October to a total of 3,893 and thence to 3,912t by 14th November. Silver is losing momentum

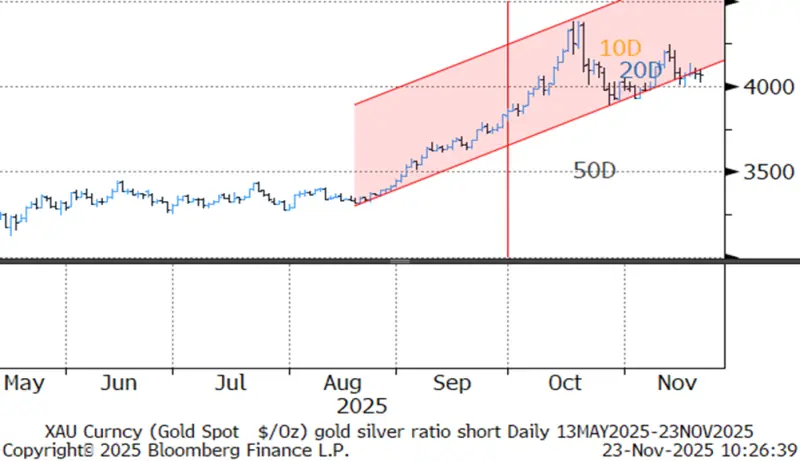

- Outlook: for the much longer term, silver has a robust fundamental outlook but for now, it is losing momentum above $50, and the chart is starting to look fragile. The solar market remains oversupplied but still has a constructive future, while AI and vehicle electrification will also help to keep the market in a pre-investment deficit. Gold is still pricing in concerns over Fed independence and the possibility of stagflation as well as underlying geopolitical risk and international tensions but here, too, the momentum has slowed. With the Fed debate taking more headlines and geopolitical swings, especially vis-à-vis Ukraine, it is still likely to catch a bid but in our view, it remains range bound between $4,000 and $4,100.

Source: Bloomberg

Silver easier in London but the market is still twitching about Critical Minerals and it would be unwise to suggest that we are out of the woods

Source: Bloomberg

Silver inventories on COMEX are divided into registered and eligible. “Eligible” inventories are inventories in a CME-approved warehouse, not necessarily delivered onto the Exchange itself; the owners of that metal may just be using the warehouse as a secured storage space. Eligible metals may belong to a range of different market participants. The CME does not have any direct control over these inventories.

When the holder of the metal delivers it onto the Exchange, then a warehouse receipt is issued and the inventories become “registered” and can then be used for delivery against futures contracts.

The gold inventories have an additional sub-division, namely “pledged” warrants. These warrants are pledged to the Exchange as collateral, which gives CME a first priority security interest in the relevant warrants. When a clearing member initiates a pledge, the warrant status changes from “Registered” to “Pledged_PB_Pending”. When the transfer to CME is complete the status becomes “Pledged_PB”. The warrants remain registered with the Exchange. Currently 54% of COMEX inventories are registered.

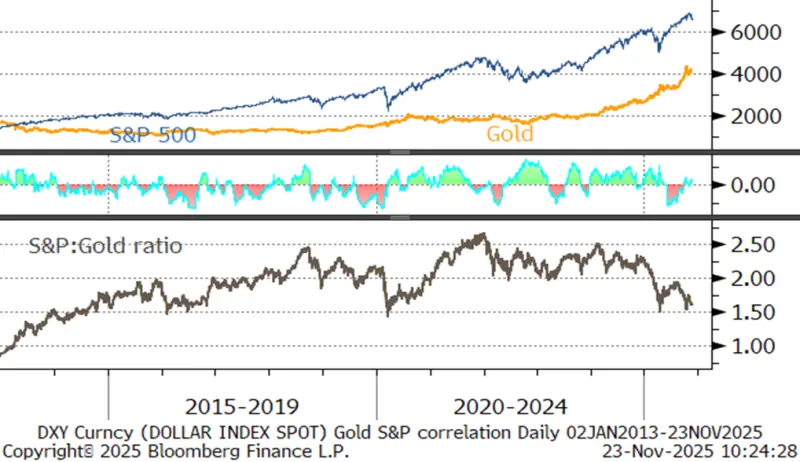

The S&P, gold and the dollar

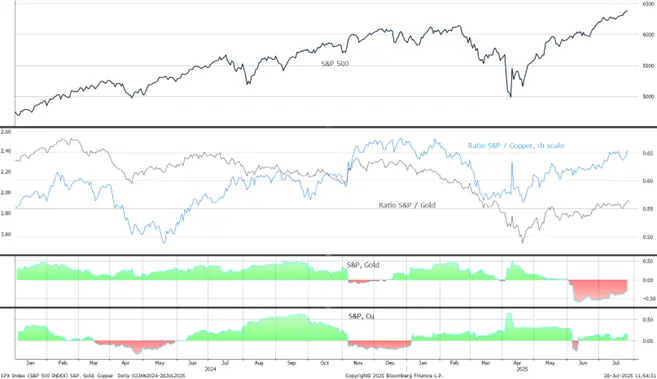

The S&P, gold and copper

Gold, one-year view; stabilising in its new range

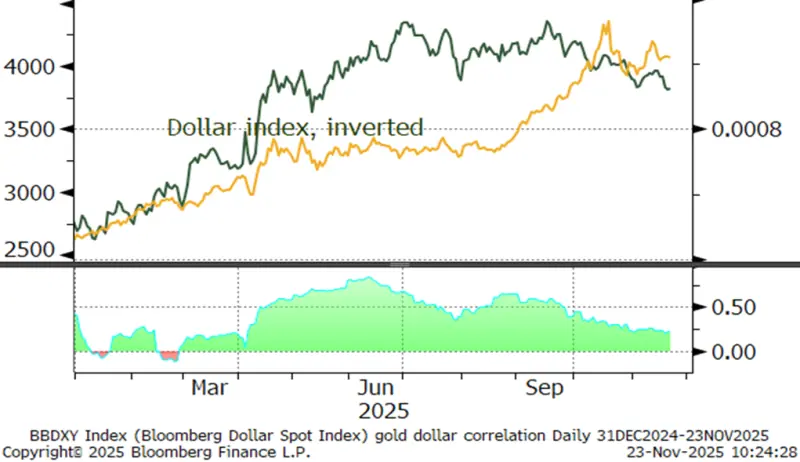

Gold:dollar correlation; easing sharply; now at-0.22

Silver, this double top could herald a fall to $43

Source: Bloomberg, StoneX

US yield curve: still steepening as the short end prices in rate cuts while the longer tenors are rising on fears of a longer-term inflationary impact; overall levels are lower, however

Source: Bloomberg, StoneX

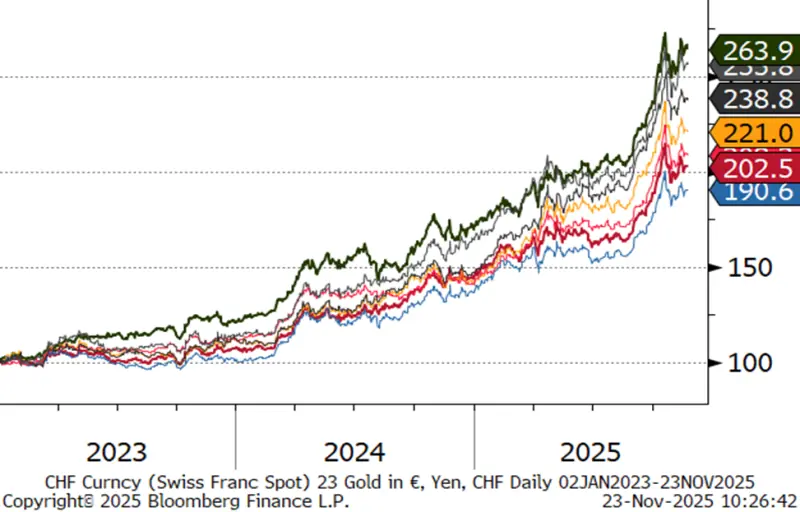

Gold in key local currencies.

Source: Bloomberg, StoneX

Gold:silver ratio, year to-date

Source: Bloomberg, StoneX

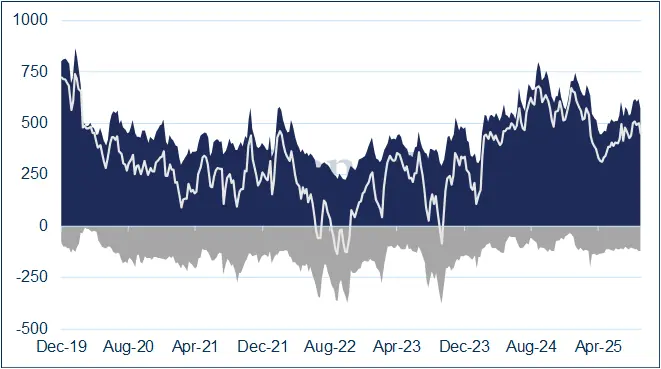

The CFTC numbers run only as far as 7th October due to the shutdown

Gold COMEX positioning, Money Managers (t) –

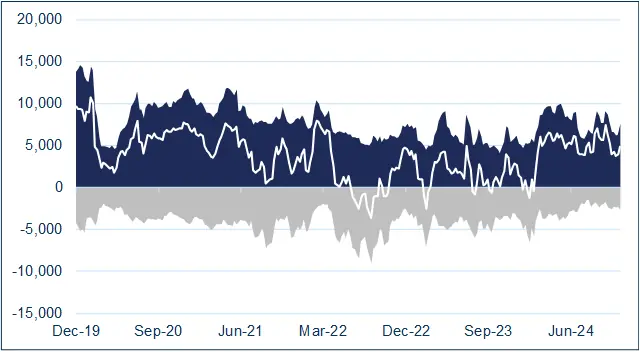

COMEX Managed Money Silver Positioning (t)

Source for both charts: CFTC, StoneX

CFTC: -

The numbers are starting to filter through now but are still way out of date. In the week to 7th October gold sentiment was mildly negative, as was silver.

Gold: MM Longs, 573; shorts, 121t.

Silver: MM Longs 8,010; shorts, 2,318t

ETF –profit taking in gold has been followed by more investment

Gold: the latest figures from the World Gold Council, up to Friday 14th November, show more gains, this time of 26t in the week, relatively evenly spread but with something of an emphasis on Asia. Year to date the net gain is 693t to stan at 3,912t compared with global mine production of just shy of 3,700t., Year-to-date, the regional changes were as follows: North America, 392t (2%); Europe, 116t (9%); Asia, 389t (80%).

Silver: Still losing momentum after that t massive surge in mid-year. Just 189t added so far over November, which is less than 1% of end-October holdings. The Bloomberg figures suggest that the net year to date gain ins a chunky 3,225t or 14Y since end-2024, to a total of 25,501t – but this may be understating the position. World mine production is just less than 26,000t.