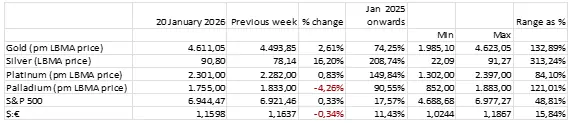

Jan 2026

Jan 2026

And the beat goes on….

By Rhona O'Connell, Head of Market Analysis

Gold has pierced $5,000 at the start of this week, with silver clearing $100 last Friday. The press is using words like “frenzy” and that’s not an over-exaggeration as people rush to join the party. I fear for the hangover, but it’s not looking as if it’s coming quite yet. Fall-out from the Japanese bond market developments this weekend provided the latest boost to gold and by association the white metals. This silver move, in particular, could end in tears.

Quick year2025 round-up

Source: Gold; World Gold Council

Silver: Metals Focus 2021-2024; Bloomberg 2025 (may be understated).

I have been dealing with the press literally all day today and am fast running out of time. So today’s content will largely reflect the emails that I have been exchanging with journalists. Plus a little on the Fed.

Key headlines:

President Trump backs off over Greenland (but gold kept moving higher)

Rick Reider (CIO Blackrock) comes to the fore as a potential for the Fed Chair

Observers think that Jay Powell may well stay on the Board after stepping down

Outlook – not much changed from last week

This massive recent gain in silver fills me with dread. In over 40 years covering this market I have seen many cataclysmic falls after aggressive bull runs. While this time it is a little different as the geopolitical background and industrial demand prognoses look to be supportive for the short-to-medium term and longer-term respectively, nonetheless there are some signs that we may be near the peak. Gold still has upside given the geopolitics that surround the market and this will help to keep silver supported for now. the most recent boost came from the ruptures in the Japanese bond market over the weekend, with the possibility of the yen carry trade unwinding, and the dollar weakened further as a result.

So while there is, in our view, still scope for further upside in both (silver is up 9% today alone, and London silver remains tight), once cracks in silver appear they could easily turn into chasms. Here is the link to last week’s piece – written before the announcement of the US DoJ probe into Fed Chair Powell, which is the StoneX submission of 2026 Precious Metals Price Forecasts for the LBMA Annual Survey

Recent price action

Gold’s latest rally came in late US hours on Friday and Asian hours today (Monday). Subsequent trading has been sideways, centred on a range of $5,50 - %5,100. High for the day so far, $5,111. Year-to-date gain, 18%. From the start of the move; 157%.

Silver‘s high so far has been posted today at $113, a thumping 57% gain since the start of the year, and an overall increase of 298% since the move started developing in early April of last year, when silver was still below $30.

The furore at these levels is seeing some FOMO buying action, but scrap coming back also. The US Mint has suspended coin sales. There is some industrial buying coming out of Asia as users are chasing prices

As far as both metals are concerned, in the latest moves algo’s are almost certainly involved and there may will have been hedging against option exposure.

Background comments: -

GOLD: this is taken directly from a Q&A email with a member of the press and should encapsulate the situation satisfactorily

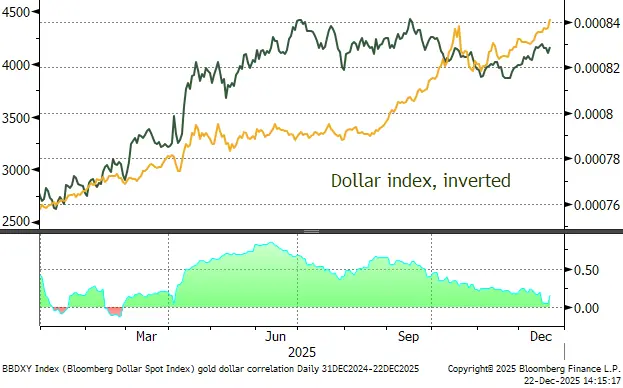

Essentially, it’s all about risk-hedging (geopolitical and financial) that has been building over the past 18 months or so and now we’ve got a massive dose of band-wagoning (or in that ghastly term, FOMO!!). The most recent boost has come from the Japanese bond market and the potential unravelling of the yen carry trade, quite apart from the more widespread ripple effect and of course the associated additional weakening of the dollar.

What is behind gold’s most recent rally to $5,000 (and is it surprising that reached this milestone so soon)? I think the speed of the move has taken everyone by surprise. although there are numerous supportive underlying factors, revolving around geopolitical and financial risk, most recently the uncertainty over the Japanese bond markets and the implications for the yen carry trade, which weakens the dollar for technical reasons. Dollar weakness is an element, but not just because gold is dollar-denominated; the dollar is a barometer of risk appetite in its own right. Some of this move is bound to be algorithm-led, adding fuel to the fire.

Is there anything different about this recent surge compared to past rallies? Probably the fact that there is an element of bandwagon, with high prices drawing in new participants. This is potentially perilous, because it can’t go on forever (although it’s probably got more to do yet).

How much of this is public vs private – i.e. central banks vs private investors? Central banks are steady in their activity; they follow carefully crafted monetary policies and don’t play the markets. So, in the short term they are a sideshow. For the longer term, quite apart from the tonnage that the official sector has taken off the market over the past four years (likely ~4,000t – for context global mine supply is ~3,700tpa), what is more important is that these net purchase levels are sending warning signals to the rest of us about the need to mitigate risk.

Forecasts: What would take the wind out of gold’s sails right now and how high could it reach in 2026? I don’t think any-one’s prepared to project a peak price. As for sails, if I had to nominate just one entity that would take some of the heat out it would be:

The Supreme Court and its ruling over the legality or otherwise the president’s efforts to fire Lisa Cook from the Fed Board of Governors for an alleged financial impropriety. This is not repeat not about a change in the balances of the Fed Board, it’s a constitutional issue. A cornerstone of the US Constitution is the separation of power between the Judiciary, the Legislative and the Executive. That Cook decision is extremely important.

Second choice: US mid-term elections and the extent to which the White House brings some stability into policy decisions this year in an effort to defend GOP seats.

Third; armed conflict and any cessation thereof.

Separately– is the rising price of gold connected to the US dollar’s ongoing slump (parallel causes)? see above. It’s all about uncertainty and international scepticism over policies.

SILVER- Essentially silver is in the midst of a self-propelled frenzy and with plenty of geopolitical risk to give gold added buoyancy, silver is benefiting, even now, from its lower unit price (notwithstanding that the gold:silver ratio is now at just over 14-year lows). The world and his wife, it seems, wants to be involved, which means that we are in dangerous territory as I fear that some people are climbing into the market at these levels without any solid grasp of the fundamentals. I often refer to silver as Cinderella (although at the moment it’s more like Icarus) – she spends a long time below stairs, usually when gold isn’t moving – but when she goes to the ball (usually courtesy of a rising gold price) she entrances everyone. But at midnight, she leaves faster than she arrived. And that is almost always how the silver price works. When it starts coming off it could be as precipitous as the rise that we’re near-vertical movements that we are seeing now. This will end in tears!

From a fundamental standpoint Asia's the big boy in this move (industrial users have been chasing prices), plus spec's, retail investors getting in on the act. US COMEX inventories still sitting tight to a degree - <=3,600t have come out but they're still, at 12,592t last Thursday, well above the pre-2025 levels of between 9,000 and 10,000t. The swollen inventories are a direct result of concerns over potential tariffs / quotas as silver has been designated a critical mineral; also the only excise tariff number that’s on the exemption list at present is ores and doré. Consequently metal in London remains tight, but not as frantically so as in October last when the EFP blew out to $45 at one stage (25% annualised). Material has been coming out of COMEX in response to the arb, that has touched $2 from time to time, I believe. Global mine production ~25,500t.

And: -

What are the main drivers behind the current silver rally? The primary driver is the markets’ concerns about tariffs and/or quotas as a Critical Mineral in the States. Fears about this took COMEX inventories from a normal 9,000-=10,000t level in 2024 to reach over 16,000t in mid-2025 as risk managers were not prepared to let metal out of the country and other operators were getting it onshore as rapidly as possible. By October London was at a $1.50 - $2 premium over New York so almost 3,600t has now left COMEX and most of it is likely to be in London. Even so, with Asian demand currently strong the London market is tight. For context, global mine production is ~25,500tpa.

Which single indicator or development would you watch most closely to judge whether this rally continues? Continued ETP selling, but more likely a slowdown in gold, which would need improvement in the geopolitical background. That said, consumers have been chasing the market so when that stops, we could easily see a recoil. When it goes, it could be calamitous.

Do you see plausible scenarios where silver reaches $150/oz, $200/oz, or even more in 2026? What would need to happen? $100 is implausible enough and I don’t believe it can be sustained.

What do you think is the most realistic factor that could cap prices or trigger a meaningful pullback? See Question 2. Gold running out of steam, which in turn would need a slowdown in the rush to that metal also, and / or improved geopolitics. A finding in favour of Lisa Cook in that incredibly important hearing at the Supreme Court.

Is silver’s supply able to respond meaningfully in the near term? Only through any acceleration in industrial scrap return or investor selling – either at grass roots levels, OTC, or ETFs. Changes in mine supply levels take months if not years – and bear in mind that only 28% of silver mine production comes from primary silver mines. The rest of mine supply is a function of the markets for lead, zinc, copper and gold, from all of which silver is a by-product.

Solar PV is one of the largest industrial consumers of silver. In your view, does PV demand meaningfully influence silver pricing? Yes, when taken along with the development of AI usage (the semiconductor chips need a heavier loading than ordinary chips) and vehicle electrification, as between them these new industries will take the market into deeper deficits that currently and will therefore be supportive. Gold prices are more important drivers, however.

At these price levels, do you expect any visible demand response from the PV industry (thrifting, substitution like copper, tech shifts), and if so, on what timeframe? It’s already happening in China but even though Cu is a strong electrical conductor there will have to be clever technological advances because it would need more space than silver.

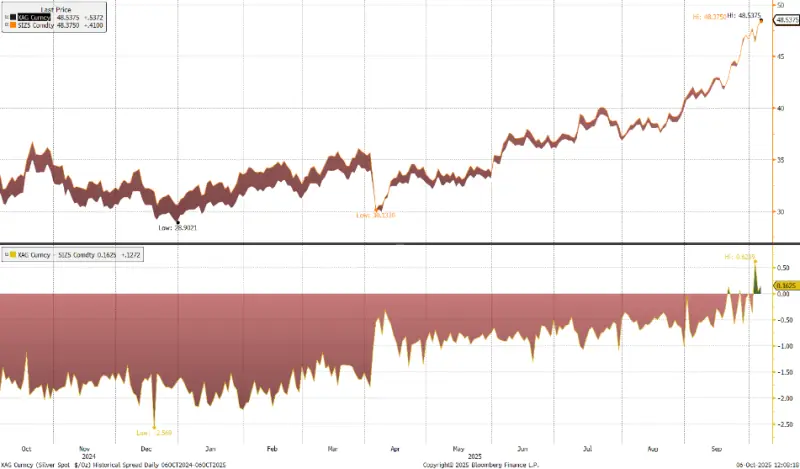

Fresh Illustration of silver’s extreme price position.

It is instructive to look at silver on a log-chart rather than a linear scale (i.e. the y-axis is expressed in logarithmic terms so that each move is shown in proportion to other moves. Thus a $10 move off a base of $10 is 100%; $10 of a $100 base is 10%, etc). This latest move is very strong by any-one’s standards and should be flashing warnings. It does look as if silver still has the scope for further gains in this environment, but buckle up when a correction ensues, as it may well be a lot more than a correction.

Log-chart of silver’s longer term price action; not quite as big as the ’78-’80 move – but very close – and see what happened back then!

Background physical moves: index rebalancing seems to have made little difference despite silver and gold being outperformers last year

The latest ETF numbers are as follows: The World Gold Council numbers run to last Friday 23rd January and show a healthy gain of 74.8t in just three weeks’ trading, of which almost 35t were in just one week. There has been a gain of with a 1.6% gain of 32.8t in North America to 2,128t; of 5.3% in Asia (23t) to 460t; and a 1.3% gain in Europe (18.2t) to 1,438t. Total; 4,065t. Massive buying in Asia last week of almost 15t, and roughly 10t in each other region.

Silver figures from Bloomberg for the year-to-date show a mixed performance, with just six days of net creations from a total of 17 trading days. Clearly there has been some profit-taking and it’s possible that some of the commodity rebalancing, which takes place at the start of each year, may have had an effect (although it would appear that there were eager buyers, especially in gold, ready to snap up anything that was coming free as a result of any rebalancing sales).

So far this year over 599t have come out of those silver ETFs that are covered by Bloomberg. After losses they stood at 26,263t at the end of last week.

Gold COMEX positioning, Money Managers (t) –

OMEX Managed Money Silver Positioning (t)

Source for both charts: CFTC, StoneX

Among the Money Managers on COMEX, gold solid, silver under profit taking

The latest CFTC figures, to 13th January, show a reasonably good increase in outright longs. Ending the year at 462t there was a dip to 456 followed by a gain to 494t. This is still only 85% of the 12-month average, so the market is not carrying an overhang in this sphere. Shorts are steady, between 70t and 75t.

Silver has been subject to profit taking here, too; in mid-December silver outright longs were as high as 6,398t; they stood last Tuesday at 3,665t, just 51% of the 12-month average. Shorts have also contracted over the period, but by just 780t.

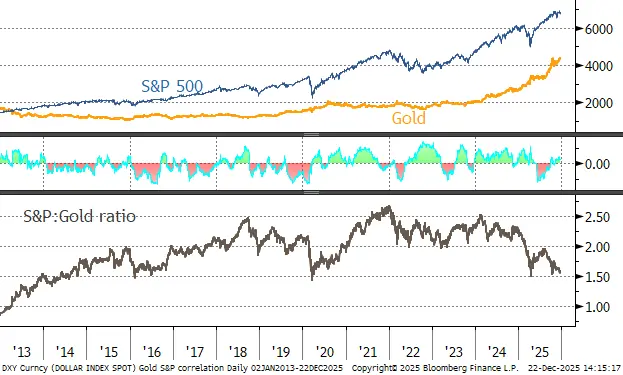

The S&P, gold and the dollar; gold:S&P marginally positive at 0.19

Source; Bloomberg, StoneX

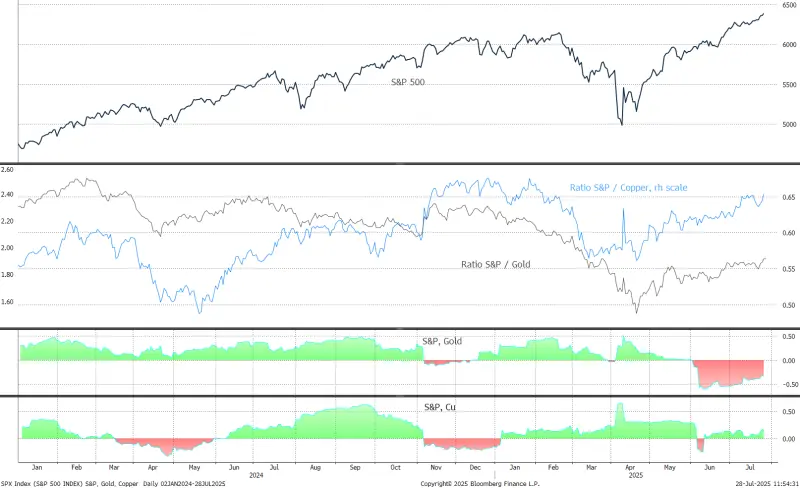

Gold, silver and copper; silver-gold 0.68; gold -copper, 0.66

Gold, one-year view; at the top of its trend channel and still overbought

Source; Bloomberg, StoneX

Silver March 2026-spot spread; flat. London still relatively tight

Source; Bloomberg, StoneX

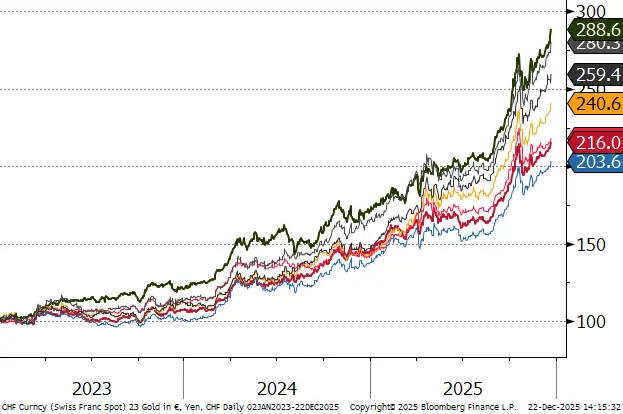

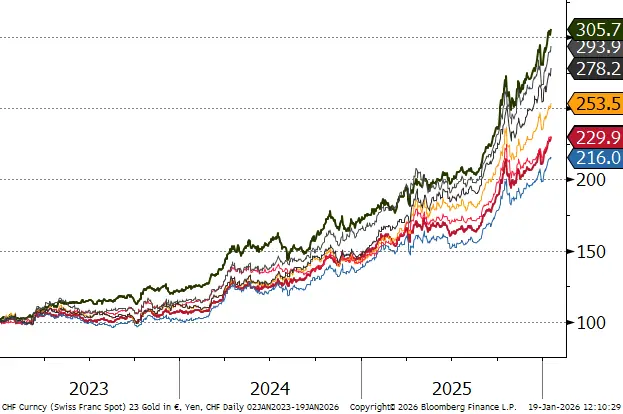

Gold in key local currencies.

Source: Bloomberg, StoneX

Gold:silver ratio, long-term; now at near 15-year lows

Source: Bloomberg, StoneX