Dec 2025

Dec 2025

Silver Surges 8% as Gold Trails; Tariffs, Fed & Geopolitics in Focus

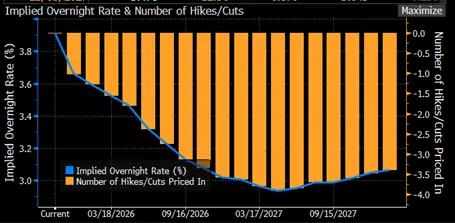

Silver’s chart defied the double top and the price is almost defying gravity! Next Wednesday 10th December is a key date.

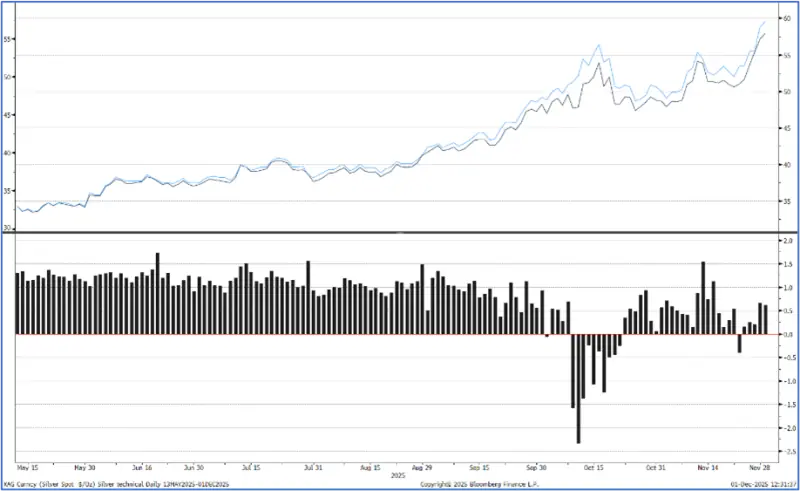

- After a relatively quiet period gold – and especially silver – volumes picked up vey smartly at the end of last week. With Thanksgiving and a CME outage exacerbating conditions, silver gained 6% on Friday and extended that move through to 8% by early London hours today Monday 1st.

- Gold’s move, by contrast, was just over 2% over the same period so silver, this time around, has moved by four times as much as gold, as opposed to the more usual beta of 2.0-2.5.

- Gold’s recent intraday high was $4,265 at the start of this week. This is a year-to-date gain of 60% although at the late October peak of $4,382 the gain was 65%.

- Silver’s gain so far this year, from $28.9 to $57.9, is 106%.

- Meanwhile the Swiss tariffs, which had been mooted at 39%, have now been brought down to 15% as a result of a deal struck in mid-November. Swiss trade in gold with the States from January to October this year has fluctuated wildly and ironically it was the massive influx of gold pre-tariffs that distorted the trade balance and would have contributed to the initial high tariff level.

- Metal is now coming back out, with over 111t coming through in September and October combined (41t and 70t respectively). Trade in the first ten months of the year still stands at a net import, of 210t.

- Silver, meanwhile, continues to capture attention, not just because of its stellar price action. Form the end of September through end-November, silver in CME warehouses has fallen from 16,531t to 14, 207t, a drop of 2,324t or 14%.

- Within those numbers, in October as the massive dislocation developed, a net 15t of silver come from the States into Switzerland, while 43t went from Switzerland into the UK, where London was experiencing that extreme shortage. The November numbers will be most illuminating.

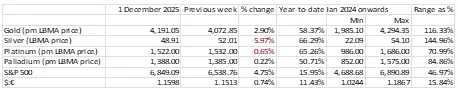

- In the background: The FOMC members are now in black-out in terms of pre-Fed meeting statements. The markets are fully pricing in a 25-point cut for next Wednesday and a further three 25-point cuts through 2026. Views are still mixed and it is unlikely that we will see a unanimous vote.

- Among the key geopolitical influences, the US-proposed Peace Agreement has run into issues in Europe and there is a NATO meeting this week, so it looks as if we are no further forward.

- The independent readings of the tone of questioning from Supreme Court judges suggests that this year’s tariffs are likely to be deemed unlawful, but there are other legal instruments that the Administration could potentially use instead. The last day of argument for the year is next Wednesday 10th December – the same day as the FOMC Statement.

- Outlook: for the much longer term, silver has a robust fundamental outlook. The solar market remains oversupplied but still has a constructive future, while AI and vehicle electrification will also help to keep the market in a pre-investment deficit. Gold is still pricing in concerns over Fed independence and the possibility of stagflation as well as underlying geopolitical risk and international tensions and both metals are lie runaway trains, which ultimately will have to slow or come off the rails. With the Fed debate taking more headlines and geopolitical swings, especially vis-à-vis Ukraine, it is still likely to catch a bid but, in our view, it remains range bound between $4,000 and $4,300.

Swaps market sicounting a 25-point cut next week and three more in 2026

Source: Bloomberg

Silver March 2026-spot spread; in contango, but a narrow one

Source: Bloomberg

Silver inventories on COMEX are divided into registered and eligible. “Eligible” inventories are inventories in a CME-approved warehouse, not necessarily delivered onto the Exchange itself; the owners of that metal may just be using the warehouse as a secured storage space. Eligible metals may belong to a range of different market participants. The CME does not have any direct control over these inventories.

When the holder of the metal delivers it onto the Exchange, then a warehouse receipt is issued and the inventories become “registered” and can then be used for delivery against futures contracts.

The gold inventories have an additional sub-division, namely “pledged” warrants. These warrants are pledged to the Exchange as collateral, which gives CME a first priority security interest in the relevant warrants. When a clearing member initiates a pledge, the warrant status changes from “Registered” to “Pledged_PB_Pending”. When the transfer to CME is complete the status becomes “Pledged_PB”. The warrants remain registered with the Exchange. Currently 54% of COMEX inventories are registered.

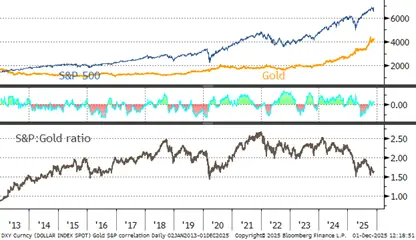

The S&P, gold and the dollar; gold:S&P marginally positive at 0.04

The S&P, gold and copper; S&P-gold 0.11; S&P Cu, 0.53

Gold, one-year view; still within its uptrend, although overbought – again. Still.

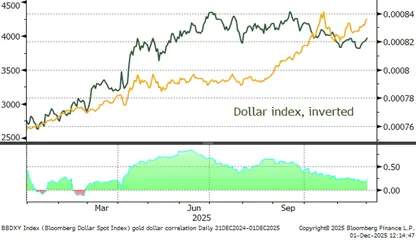

Gold:dollar correlation; steadying; now at-0.21

Source: Bloomberg, StoneX

Silver, pushing on fuelled by solid industrial outlook and continued FOMO momentum.

Source: Bloomberg, StoneX

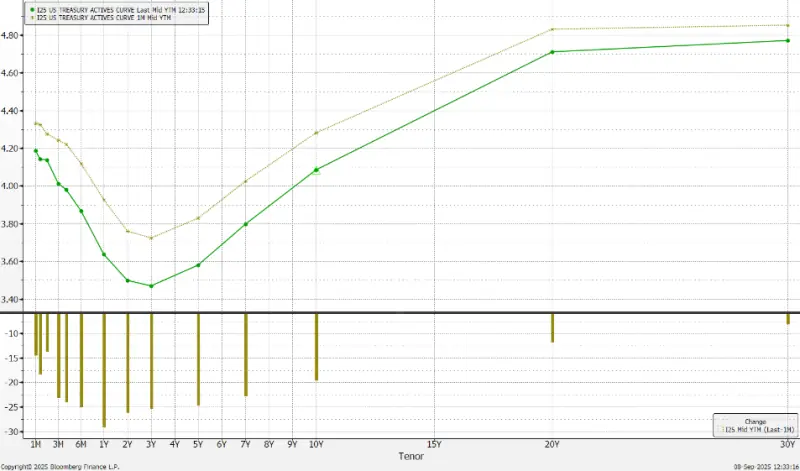

US yield curve: steeper, triggered this week by weaker Japanese bonds on government hints of a rate rise during December

Source: Bloomberg, StoneX

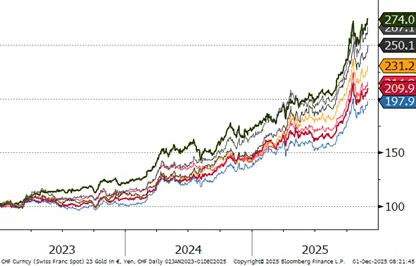

Gold in key local currencies.

Source: Bloomberg, StoneX

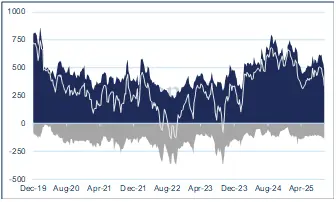

Gold:silver ratio, year to-date; now testing lows hit four times in as many years, just above 73.

Source: Bloomberg, StoneX

The CFTC numbers run only as far as 14th October due to the shutdown

Gold COMEX positioning, Money Managers (t) –

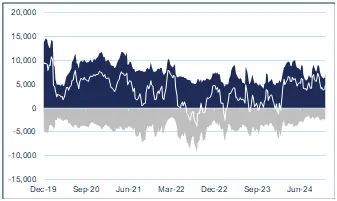

COMEX Managed Money Silver Positioning (t)

Source for both charts: CFTC, StoneX

CFTC: -

The numbers are starting to filter through now but are still way out of date. In the week to 14th October gold sentiment was still mildly negative, as was silver.

Gold: MM Longs, 473, down from 573 a fortnight previously (-17%); shorts, 137t from 121t. (+13%)

Silver: MM Longs 6,318t from 8,010t (-21%); shorts, 2,530t from 2,318t (+9%)

ETF –profit taking in gold has been followed by more fresh investment, geographical shifts.

Gold: the latest figures from the World Gold Council, up to Friday 21st November, show continued gains, this time slightly lower, at 18.3t in the week, an interesting geographical twist; net redemptions of 3.5t and 1.4t in North America and Europe respectively, and gains of 8.0t in Asia, of which 6.5t were in Mainland China and 1.5t in Japan. Year to date the net gain is 696t to stand at 3,915t compared with global mine production of just shy of 3,700t. Year-to-date, the regional changes were as follows: North America, 394t (24%); Europe, 115t (9%); Asia, 397t (83%).

Silver: Still losing momentum after that massive surge in mid-year. There were plenty of days of small net redemptions in November, punctuated by two days of heavy net creations for a net overall increase of 487t, equivalent to 2% of end-October holdings. The Bloomberg figures suggest that the net year to date gain is a chunky 3,526t or 15% since end-2024, to a total of 25,802t – but this may be understating the position. World mine production is just less than 26,000t.